How to Build a FinTech Company

Updated on : 06 March 2025

Image Source: google.com

Table Of Contents

- 1. Introduction to FinTech

- 2. Steps to Start a FinTech Company

- 3. Major Technologies Required for Building a FinTech Startup

- 4. Two Primary Approaches to Building Your FinTech Offering

- 5. Addressing Challenges: Mitigating Risks in the FinTech Industry

- 6. Navigating Regulatory Compliance

- 7. Securing Funding for Your FinTech Startup

- 8. Developing a Minimum Viable Product (MVP)

- 9. Product Launch and Marketing Strategies

- 10. Scaling and Expanding Your FinTech Business

- 11. FAQs

Table Of Contents

Introduction to FinTech

FinTech, short for "financial technology," refers to the use of digital technologies to deliver financial services and solutions. It has revolutionized the way financial transactions are conducted, making them faster, more secure, and accessible to a broader audience. The fintech industry is growing rapidly, with the global market size projected to reach over $1152 billion by 2032, driven by innovations in technologies like AI, blockchain, and IoT. FinTech companies are transforming traditional financial services by providing more efficient, personalized, and cost-effective solutions.

Image Source: google.com

Hexadecimal Software offers expert Java development services for building robust fintech applications. Their team can help design and develop scalable software solutions tailored to your fintech needs.

Key Areas in FinTech

| Area | Description |

|---|---|

| Payments | Digital payment systems, including mobile wallets and online payment gateways. |

| Lending | Peer-to-peer lending platforms and digital credit scoring systems. |

| Investments | Robo-advisors and digital investment platforms for stocks and cryptocurrencies. |

| Insurance | Digital insurance platforms offering personalized policies and claims management. |

Ready to Launch Your Innovative FinTech Venture? Let's Discuss Your Vision

Steps to Start a FinTech Company

Starting a fintech company involves several key steps that require careful planning and execution.

Step 1: Conduct Market Research

Conducting thorough market research is essential to understand current trends, identify customer needs, and analyze competitors. This involves gathering data on consumer behavior, market size, and potential growth areas.

Step 2: Select a Niche

Focus on a specific area within fintech, such as payments, lending, or investment. Specializing in a niche allows you to tailor your services to meet specific customer needs and differentiate yourself from competitors.

Step 3: Build Your Team

Hire professionals with expertise in finance and technology. A strong team should include developers, financial analysts, marketing specialists, and compliance officers.

Step 4: Ensure Regulatory Compliance

Meet legal requirements such as Anti-Money Laundering (AML) and Know Your Customer (KYC). Compliance is crucial to avoid legal issues and maintain customer trust.

Step 5: Secure Funding

Obtain necessary capital through investors or crowdfunding. Securing funding can help scale your operations and invest in technology and talent.

Detailed Steps Table

| Step | Description | Importance |

|---|---|---|

| Market Research | Understand market trends and customer needs. | Essential for strategic planning. |

| Niche Selection | Focus on a specific fintech area. | Helps differentiate your company. |

| Team Building | Hire skilled professionals. | Crucial for operational success. |

| Regulatory Compliance | Meet legal requirements. | Ensures legal and ethical operations. |

| Funding | Secure capital for growth. | Necessary for scaling and innovation. |

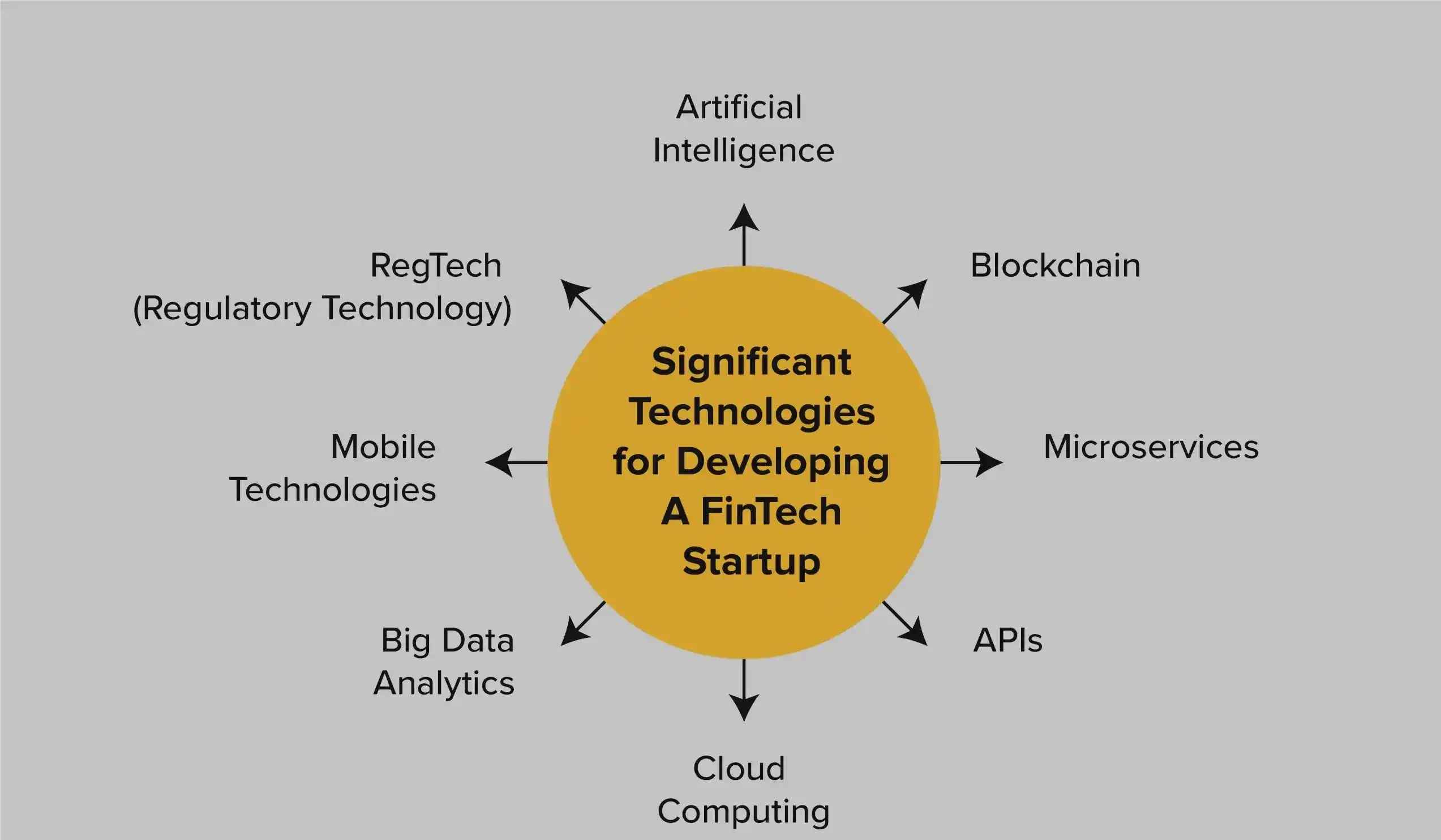

Major Technologies Required for Building a FinTech Startup

Image Source: google.com

The following technologies are crucial for fintech startups:

| Technology | Description |

|---|---|

| Artificial Intelligence (AI) | Enhances efficiency, detects fraud, and offers personalized services. |

| Blockchain | Provides secure, transparent transactions and decentralized data management. |

| Internet of Things (IoT) | Enables real-time data collection and automation. |

| Cybersecurity | Protects sensitive customer data and ensures secure transactions. |

| Cloud Computing | Offers scalable infrastructure for data storage and processing. |

| Big Data Analytics | Analyzes customer behavior and financial trends. |

Secure your fintech transactions with blockchain technology developed by Hexadecimal Software. Their blockchain solutions ensure transparency, security, and trust in financial transactions.

Benefits of Key Technologies

| Technology | Benefits |

|---|---|

| AI | Improved customer service, fraud detection, and operational efficiency. |

| Blockchain | Enhanced security, transparency, and trust in transactions. |

| IoT | Real-time data for better decision-making and automation. |

| Cybersecurity | Protects against data breaches and cyber threats. |

| Cloud Computing | Scalable and cost-effective infrastructure. |

| Big Data Analytics | Insights into customer behavior and market trends. |

Two Primary Approaches to Building Your FinTech Offering

- Collaborating with a BaaS Provider: Partner with a Banking-as-a-Service provider to leverage existing infrastructure and regulatory compliance. This approach allows for faster market entry with less upfront investment.

- Forming a Direct Partnership with a Bank: Collaborate directly with banks for more control over services and customization. This approach requires more resources but offers greater flexibility and potential for innovation.

Comparison of Approaches

| Approach | Advantages | Disadvantages |

|---|---|---|

| BaaS Partnership | Faster market entry, less upfront cost. | Less control over services. |

| Direct Bank Partnership | More control, customization potential. | Higher costs, more complex setup. |

Addressing Challenges: Mitigating Risks in the FinTech Industry

Fintech companies face challenges such as regulatory compliance, cybersecurity threats, and market competition. To mitigate these risks, companies should invest in robust security measures and stay updated on regulatory changes.

Risk Mitigation Strategies

| Risk | Mitigation Strategy |

|---|---|

| Regulatory Non-Compliance | Regularly update compliance policies and train staff. |

| Cybersecurity Threats | Implement robust security protocols and conduct regular audits. |

| Market Competition | Innovate continuously and focus on customer satisfaction. |

Navigating Regulatory Compliance

Image Source: google.com

Fintech companies must comply with strict regulations, including AML, KYC, and GDPR. Consulting legal experts can help navigate these complex requirements and ensure that your operations are legally sound.

Key Regulations

| Regulation | Description |

|---|---|

| AML (Anti-Money Laundering) | Prevents money laundering activities. |

| KYC (Know Your Customer) | Ensures customer identity verification. |

| GDPR (General Data Protection Regulation) | Protects personal data of EU citizens. |

Securing Funding for Your FinTech Startup

Securing funding is crucial for fintech startups. This can be achieved through venture capitalists, angel investors, or crowdfunding platforms. A solid business plan and a clear vision for growth are essential for attracting investors.

Funding Options

| Funding Option | Description |

|---|---|

| Venture Capitalists | Provide large sums for growth in exchange for equity. |

| Angel Investors | Offer early-stage funding with less formal requirements. |

| Crowdfunding | Raises funds from a large number of people, often through online platforms. |

Building a FinTech Startup? Explore Our Expert Solutions

Developing a Minimum Viable Product (MVP)

An MVP is a streamlined version of your product that includes essential features to test market demand and gather feedback. Developing an MVP allows you to refine your product based on user insights before investing in a full-scale launch.

Image Source: google.com

MVP Development Steps

- Define Core Features: Identify the most important features for your MVP.

- Design and Develop: Build the MVP with a focus on user experience.

- Test and Iterate: Launch the MVP, gather feedback, and make necessary improvements.

Product Launch and Marketing Strategies

After developing your MVP, focus on launching your product and implementing effective marketing strategies to reach your target audience. This includes leveraging social media, content marketing, and partnerships to build brand awareness and drive user acquisition.

Marketing Channels

| Channel | Description |

|---|---|

| Social Media | Engage with customers and promote services through platforms like Twitter and Facebook. |

| Content Marketing | Create informative content to educate and attract potential customers. |

| Partnerships | Collaborate with other businesses to expand your reach. |

Leverage big data analytics to understand customer behavior and market trends. Hexadecimal Software's analytics services provide actionable insights that can drive business growth and innovation.

Scaling and Expanding Your FinTech Business

Once established, focus on scaling your business by expanding services, entering new markets, and continuously innovating to stay competitive. This may involve investing in new technologies, hiring more talent, and exploring strategic partnerships.

Scaling Strategies

| Strategy | Description |

|---|---|

| Service Expansion | Offer new services to existing customers. |

| Market Expansion | Enter new geographic markets or customer segments. |

| Innovation | Stay ahead by adopting emerging technologies and trends. |

FAQs

- Q: What is FinTech?

A: FinTech refers to the use of technology to improve financial services. - Q: How do I start a FinTech company?

A: Start by conducting market research, selecting a niche, building your team, and ensuring regulatory compliance. - Q: What are the key technologies used in FinTech?

A: Key technologies include AI, blockchain, IoT, cybersecurity, cloud computing, and big data analytics.

References

-

AI/ML Development Services: Elevate your business with cutting-edge AI solutions. They offer AI-based IoT, cloud services, predictive analytics, AI software development, and voice recognition to optimize processes and enhance decision-making.

-

Blockchain Development Services: Unlock the future of trust with blockchain technology. Services include blockchain protocol development, dApps, custom blockchain app development, NFT marketplace development, crypto wallets, and asset tokenization.

-

Cloud Computing Services: Streamline operations and save costs with their leading cloud computing services. They offer cloud migrations, CI/CD pipelines, containerization, virtualization, DevOps consultation, and more.