Credit Card Fraud Detection Using Machine Learning

Updated on : 07 April 2025

Image Source: google.com

Table Of Contents

- 1. Introduction

- 2. Common Types of Credit Card Fraud

- 3. Traditional Approaches to Fraud Detection

- 4. The Rise of Machine Learning in Fraud Detection

- 5. Real-World Industry Applications

- 6. Integrating Machine Learning into Business Models

- 7. Advanced ML Capabilities for Fraud Detection

- 8. Key Challenges in Fraud Detection

- 9. Benefits of Using Machine Learning

- 10. Business Case Study

- 11. Strategic Implementation Tips

- 12. Future Trends in Fraud Detection

- 13. FAQs

Table Of Contents

Introduction

Credit card fraud detection with machine learning is a smart way to fight financial crime. By spotting unusual spending patterns in real-time, ML models can catch fraud fast—often before it causes damage. It's a powerful blend of data, speed, and security for safer transactions.

Common Types of Credit Card Fraud

Image Source: google

-

📞 Phishing Scams

Fraudsters trick you via fake emails, calls, or texts to steal your card details by pretending to be your bank. -

👀 Skimming Devices

Tiny hidden devices at ATMs or gas pumps copy your card’s data when you swipe, without you even knowing. -

💻 Online Shopping Fraud

Your card info gets stolen during unsafe online transactions or on fake shopping websites. -

🕵️ Account Takeover

Hackers gain control of your account, change your credentials, and start making unauthorized purchases. -

🧾 Fake Credit Card Generation

Fraudsters use software to randomly generate valid card numbers and test them for working combos. -

📦 Lost or Stolen Cards

A thief finds or steals your card and quickly uses it before you report it lost. -

👤 Identity Theft

Criminals open new credit card accounts in your name using stolen personal information.

Traditional Approaches to Fraud Detection

| Fraud Detection Method | Description |

|---|---|

| Rule-Based Systems | Use predefined rules (e.g., spending limits or location filters) to flag suspicious transactions. |

| Manual Review | Human analysts inspect flagged transactions to confirm if fraud has occurred. |

| Blacklists | Block transactions from known suspicious users, devices, or IP addresses. |

| Transaction Limits | Set thresholds for daily or per-transaction spending to reduce large-scale fraud. |

| Pattern Matching | Detect fraud by comparing current behavior to past transaction patterns. |

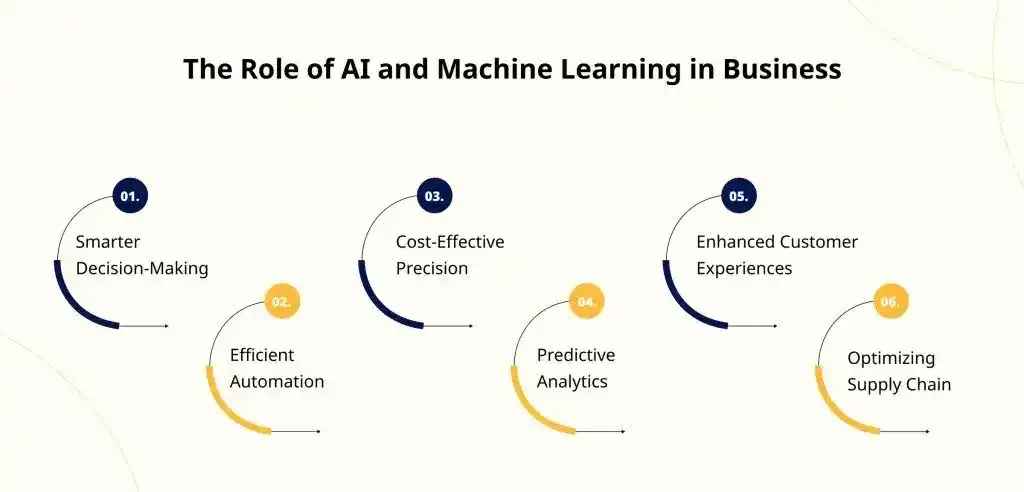

The Rise of Machine Learning in Fraud Detection

Image Source: google

-

Real-Time Detection

ML models analyze transactions instantly, flagging fraud as it happens—far faster than traditional systems. -

Adaptive Learning

Algorithms learn from new fraud patterns and evolve over time, improving accuracy without needing constant manual updates. -

Behavior Analysis

ML studies user habits (e.g., location, time, spending patterns) to detect subtle anomalies that humans might miss. -

Reduced False Positives

By understanding context, ML helps avoid flagging legitimate transactions as fraud—keeping customers happy. -

Big Data Advantage

ML can process massive datasets from multiple sources, finding fraud signals hidden in noise. -

Automation at Scale

With minimal human input, ML systems can monitor millions of transactions simultaneously and efficiently.

Real-World Industry Applications

Ready to Revolutionize Your Business with Intelligent AI & ML Solutions?

| 🏢 Industry | 🧠 ML Fraud Detection Use |

|---|---|

| 🏦 Banking & Finance | Detect suspicious transactions, unusual account behavior, and prevent identity theft. |

| 🛍️ E-Commerce | Flag fake purchases, refund scams, and card testing fraud in real time. |

| 📱 FinTech Apps | Analyze in-app payments, peer transfers, and automate fraud alerts. |

| 🏥 Healthcare | Prevent insurance fraud, fake billing, and identity misuse in patient records. |

| 🎮 Gaming Platforms | Stop credit card abuse in microtransactions and detect bot-driven fraud. |

Integrating Machine Learning into Business Models

Image Source: google

-

Define the Problem

Identify specific business challenges where ML can add value—like fraud detection, customer churn, or sales forecasting. -

Collect Quality Data

Gather clean, relevant data from business operations to train accurate and reliable ML models. -

Choose the Right Model

Select algorithms that suit your needs—like decision trees for classification or neural networks for pattern recognition. -

Embed in Workflow

Integrate ML outputs into daily operations, such as flagging risky transactions or automating decisions. -

Monitor & Improve

Continuously track performance, retrain models with new data, and refine them for better accuracy over time. -

Ensure Compliance & Ethics

Maintain transparency, privacy, and fairness while deploying ML in customer-facing or sensitive areas.

Transform Your Business with Hexadecimal’s Blockchain Expertise

Advanced ML Capabilities for Fraud Detection

| ML Capability | Description |

|---|---|

| Anomaly Detection | Identifies unusual transaction patterns that deviate from normal user behavior. |

| Supervised Learning | Trains models on labeled fraud data to classify future transactions as legitimate or fraudulent. |

| Unsupervised Learning | Detects hidden fraud patterns without needing labeled data, useful for unknown fraud types. |

| Reinforcement Learning | Learns and adapts from feedback in real-time to improve detection over time. |

| Natural Language Processing (NLP) | Analyzes textual data like user reviews or support chats to detect potential fraud signals. |

Key Challenges in Fraud Detection

Want to Elevate Your Financial Security with Blockchain-Powered Fraud Detection?

-

🎭 Evolving Fraud Tactics

Fraudsters keep changing strategies, making it hard for static systems to stay effective. -

🚫 High False Positives

Legitimate transactions often get flagged, causing inconvenience and loss of customer trust. -

⚖️ Data Imbalance

Fraud cases are rare compared to normal ones, which can bias machine learning models. -

⏱️ Real-Time Detection Needs

Systems must detect fraud instantly without slowing down user experience or transactions. -

🛡️ Privacy & Compliance

Solutions must follow strict data protection laws (like GDPR), which adds complexity to system design. -

🔄 Continuous Learning Requirement

Fraud detection models need regular updates and retraining to stay accurate and relevant.

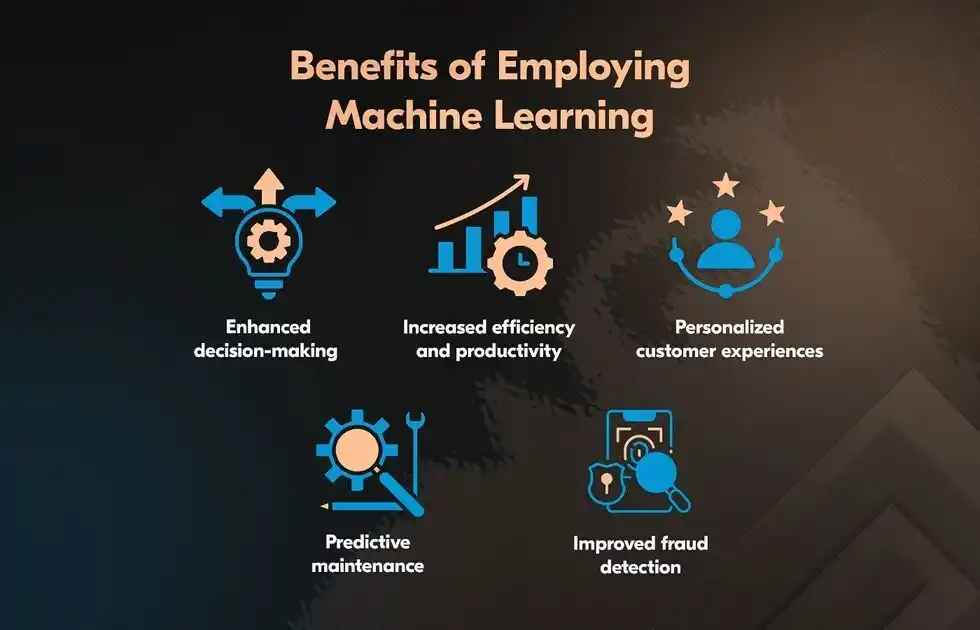

Benefits of Using Machine Learning

Image Source: google

| ✅ Benefit | 📌 Description |

|---|---|

| Real-Time Detection ⚡ | Instantly flags suspicious transactions, reducing response time and damage. |

| Improved Accuracy 🎯 | Reduces false positives and better detects complex fraud patterns. |

| Scalability 📈 | Handles millions of transactions efficiently without human intervention. |

| Adaptive Learning 🔁 | Continuously improves by learning from new data and emerging fraud tactics. |

| Cost Efficiency 💰 | Minimizes manual work, reducing operational costs and boosting ROI. |

| Enhanced User Trust 🤝 | Accurate detection builds customer confidence in digital transactions. |

Business Case Study

-

About

A leading mobile app development company delivering innovative digital solutions across industries. -

Challenge

Clients in fintech and e-commerce needed robust, real-time fraud detection systems integrated into their apps. -

ML-Powered Solution

Hexadecimal's implemented machine learning models to detect and prevent fraud using user behavior analytics and anomaly detection. -

Key Technologies

Used algorithms like decision trees, logistic regression, and neural networks along with real-time data pipelines. -

Impact

- 60% reduction in fraudulent transactions

- Improved customer trust

- Seamless integration without affecting app performance

- Industry Reach

Delivered ML-based fraud solutions for global clients across fintech, retail, and healthcare domains.

Strategic Implementation Tips

| Strategy Tip | Description |

|---|---|

| Start Small & Scale | Begin with a pilot project to test ML models, then expand based on results. |

| Use Quality Data | Ensure clean, relevant, and diverse datasets to train accurate models. |

| Cross-Functional Teams | Involve data scientists, domain experts, and developers for effective implementation. |

| Monitor & Improve | Continuously evaluate model performance and retrain with new data. |

| Ensure Compliance | Align ML systems with privacy laws (like GDPR) and ethical standards. |

| Integrate with Systems | Embed ML into existing workflows and tools for smooth operations. |

Future Trends in Fraud Detection

Image Source: google

-

🧠 AI-Powered Automation

Advanced AI models will automate fraud detection end-to-end, from analysis to action—reducing human involvement. -

🌐 Real-Time Global Monitoring

Cross-border fraud detection systems will enable faster identification of international fraud patterns. -

🔗 Blockchain Integration

Transparent and tamper-proof blockchain systems will help verify transactions and identities more securely. -

📱 Biometric Authentication

Fingerprint, facial recognition, and voice-based verification will add extra layers of fraud prevention. -

🎯 Hyper-Personalized Detection

Systems will tailor fraud detection to individual user behavior, improving accuracy and reducing false positives. -

🧩 Federated Learning

ML models will be trained across multiple decentralized sources without compromising user privacy. -

🚨 Predictive Analytics

Using historical and behavioral data, systems will not just detect but predict potential fraud before it happens.

FAQs

Q.1.What is credit card fraud detection using machine learning?

A : It’s the use of ML algorithms to analyze transaction data and identify suspicious or fraudulent activity automatically.

Q.2.How does machine learning detect fraud?

A : ML models learn from past transaction patterns (fraudulent and legitimate) to spot unusual behavior in real-time.

Q.3.What types of algorithms are used?

A : Common algorithms include decision trees, logistic regression, random forests, neural networks, and k-nearest neighbors (KNN).

Q.4.What kind of data is used for training ML models?

A : Transaction data like amount, location, time, device info, and user behavior (e.g., spending habits).

Q.5.Why is machine learning better than rule-based systems?

A : ML adapts over time, handles complex patterns, and reduces false positives—unlike static, predefined rules.

Q.6.Can ML detect fraud in real time?

A : Yes! Many systems are designed to flag suspicious activity within milliseconds of a transaction occurring.